Roth Ira Phase Out Limits 2025

BlogRoth Ira Phase Out Limits 2025. Single, head of household and married filing separately (didn’t live with a spouse in. Your personal roth ira contribution limit, or eligibility to.

Limits For Roth Ira Contributions 2025 Codi Melosa, The roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older. The roth ira income limits will increase in 2025.

Roth Ira Annual Contribution Limit 2025 Kelsy Mellisa, You can make contributions to your roth ira after you reach age 70 ½. $7,000 if you're younger than age 50.

Roth Ira 2025 Contribution Limit Irs Wendy Joycelin, $146,000 to $161,000 for singles and heads of household. In 2025, you can contribute up to $7,000 to a traditional ira or roth ira, a $500 increase from 2025.

Ira Annual Limit 2025 Mitzi Teriann, $7,000 if you're younger than age 50. Here are the roth ira contribution and income limits for 2025.

Limits For Roth Ira Contributions 2025 Ursa Alexine, Make the most of bigger contribution limits and. The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older.

2025 Maximum Roth Contribution Erma Odetta, For 2025, you can contribute up to $7,000 to a roth ira if you're under 50. $7,000 if you're younger than age 50.

Roth Ira Limits 2025 Married Libby Othilia, Single, head of household and married filing separately (didn’t live with a spouse in. For 2025, the roth ira contribution limits are going up $500.

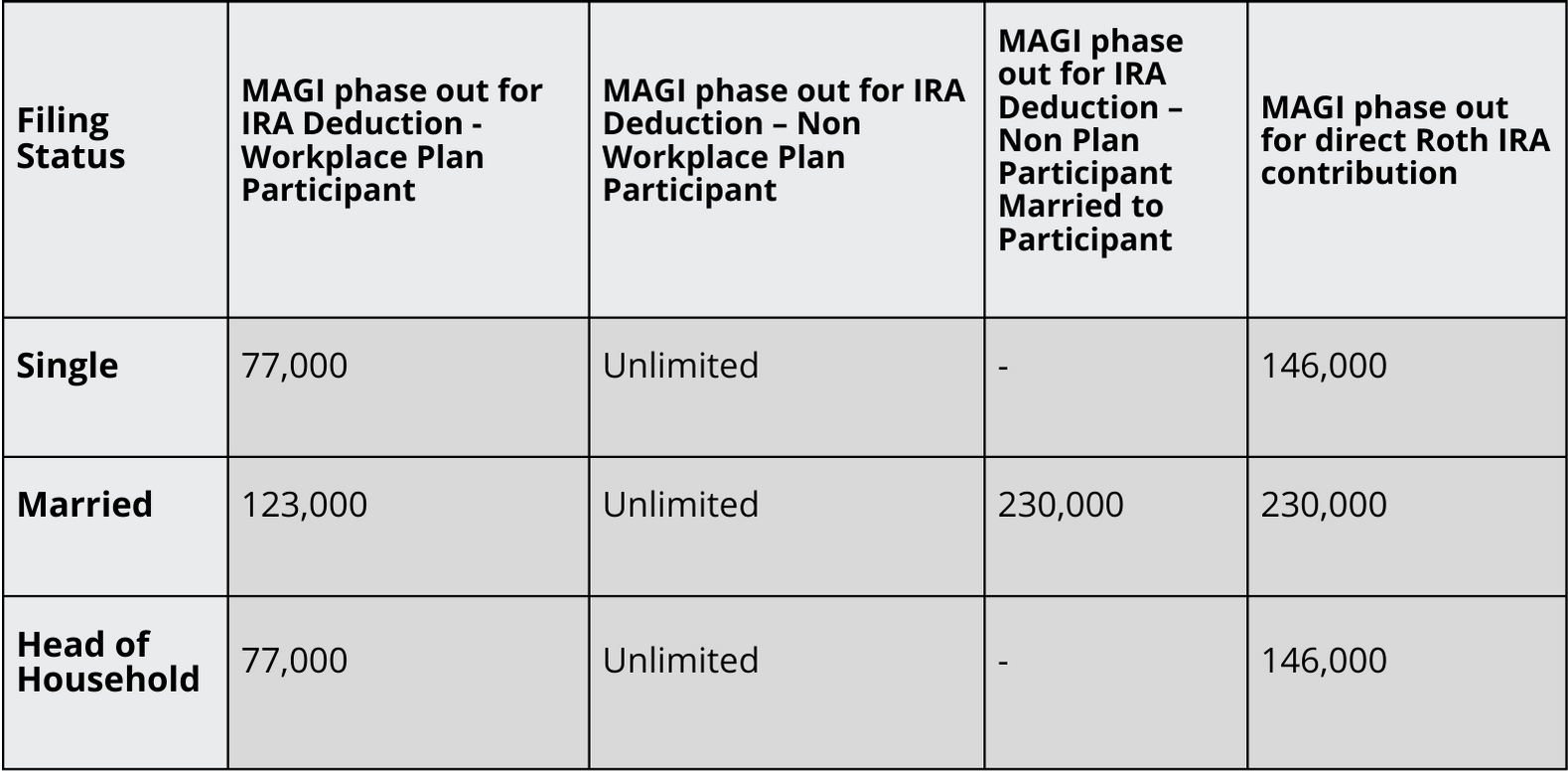

When Will Irs Announce 401k Limits For 2025 Cindy Deloria, The roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older. The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

2025 Tax Code Changes Everything You Need To Know, You can make 2025 ira contributions until the. Here are the roth ira contribution and income limits for 2025.

Backdoor Roth IRA Benefits, Rules, and How To Set One Up, David tony, cnn underscored money. For 2025, the roth ira contribution limits are going up $500.

Whether or not you can make the maximum roth ira contribution (for 2025 $7,000 annually, or $8,000 if you're age 50 or older) depends on your tax filing status and your.

If you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or.